WENDELL HUSSEY | Cadet | CONTACT

As another day dawns, another major bank has revealed a bumper profit.

The Commonwealth Bank, the most powerful member of the banking cartel in Australia has today revealed that it’s made a cash profit of 2.5 billion dollars.

While 2.5 billion dollars seems like a pissy amount of coin, the eye watering amount is actually only the quarterly yearly profit, and follows their 2022-23 yearly profit of 10 billion Australian pesos.

The staggering profit continues the ongoing trend of giant corporations revealing huge margins amidst a cost of living crisis that has seen people face doubled rents, crazily expensive groceries and bills soaring through the roof.

The sharp uptick in the cost of living has been marketed as something that comes with uncertain economic times, that have nothing to do with the governments and people in charge of our economy and our financial system.

A major factor in the strangling cost of living crisis pushing more people into food and housing insecurity than ever before has been the constant raising of interest rates by the Reserve Bank, who have no other tools to control an inflationary surge which is being driven by external factors like global conflict, price gouging and corporate profiteering.

However, the uncomfortable fact that the growing Australian peasant class is being fucked by corporations like the Commonwealth Bank, is something that isn’t great for an ad campaign.

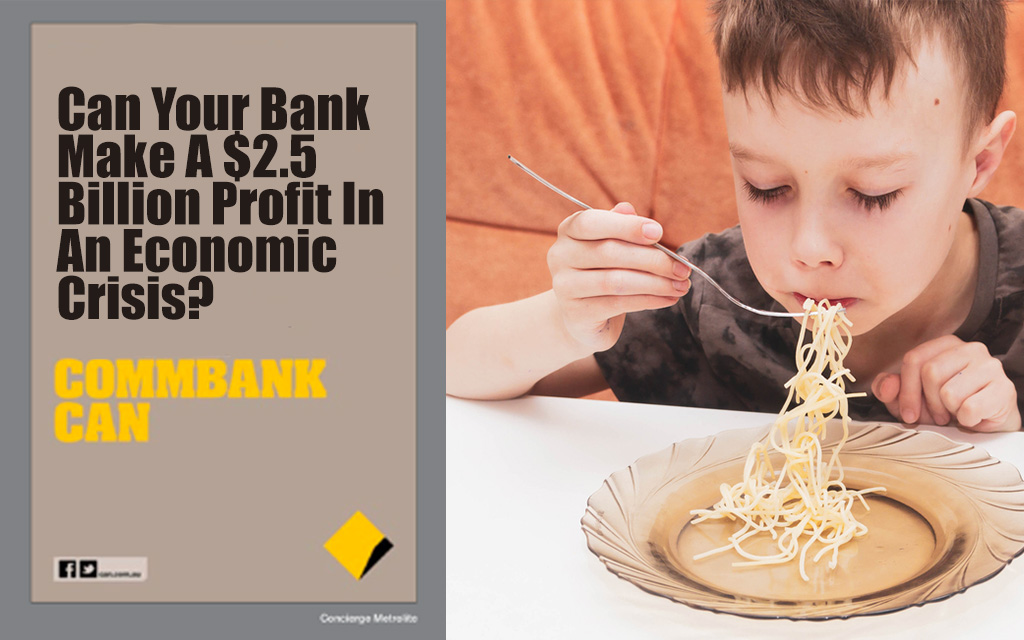

So, in an effort to make their profiteering a little more palatable, the bank famous for the most feel good campaigns has tried to soften the blow with a new outdoor and digital advertising blitz.

The overarching message behind the campaign is reportedly not what they can’t do (like stop profiteering of an inflation crisis), but more what they can do.

“It’s time to focus on some of our big achievements, like ripping off dead customers, selling dodgy financial products, offering predatory loans and making billions of dollars in profit while ordinary Australians are struggling to put food on the table,” said a CommBank spokesperson.

“Which Bank? CommBank Can.”