WENDELL HUSSEY | Cadet | CONTACT

A pair of middling local property moguls have today spoken to The Advocate after the Reserve Bank’s latest meeting.

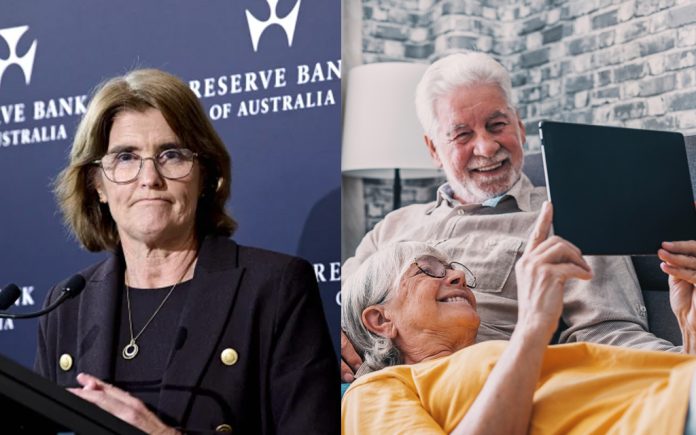

Alistair and Wendy Whitely-Smith confirmed to The Advocate that they are very pleased that Governor Michele Bullock has decided to cut interest rates.

The milestone moment saw the RBA cut the cash rate by 25 basis points, dropping it to 3.85% – and making it a much more pleasant number for anyone with a mortgage.

The cutting comes after a big few years of interest rate hikes, which were very quickly passed on by the banks and landlord’s down the trickle down tree.

While of course banks will likely twiddle their thumbs for as long as possible on the interest rates for loans, despite immediately lowering interest rates for savings, the local pair of landlords have confirmed they’ll also be kicking tyres for a bit.

“Haha, absolutely no need to be rushing into anything,” laughed Alistair Whitely-Smith after the news.

“We’ve been through a lot over the last couple of years, so I think it’s fair for us to get a little bit of extra compensation for that.”

The quiet slap down of a rent cut, comes after three rent rises over the last three years in line with interest rates.

As is the norm, the investors passed on their costs to the poor people unable to own their home.

“Look, it’s really not our problem if some of our tenants are struggling to pay their rent,” said Alistair.

“We aren’t a charity,” said the strong beneficiaries of the taxation system geared towards property investors.

“And we certainly aren’t just dropping rent because the RBA cut rates,” finished the couple that put up rents because rates went up.

More to come.